As financial advisors, we often get asked the best way to save for retirement. Like most planning decisions, the answer is, “It depends on your individual circumstances.” The retirement planning advisors at Foster & Motley are here to provide you with a personalized answer and help you make sure you are ready for retirement.

How should you prioritize the accounts you use to save for retirement?

The first step when it comes to retirement savings is just doing it in the first place. The best time to start saving is as soon as possible. Unfortunately, walking away from school with a mountain of student loan debt is quickly becoming the new normal for college graduates, and in some cases, their parents. This makes an early start to saving more difficult. For young workers, retirement planning seems a long way off; they think they have plenty of time to save later. But, the power of compound growth is significant; the longer you wait, the more you will have to set aside each month to get to the same result.

But I digress. Which accounts should you use, and in what order? The typical accounts for retirement saving are an employer sponsored plan such as a 401(k) or 403(b), an IRA, a Roth IRA and a taxable investment account.

Factors that are important to consider:

-

What type of plan is offered by your employer?

-

How does your income compare to your spending needs?

-

What is your tax rate?

-

Does your employer match any dollars saved by you?

-

Could you need access to savings before age 59 ½? How disciplined are you at saving?

Employer Plan

If you work for an employer that offers a matching contribution, then your easiest decision is to save here first and earn that match. We call this “free money”. Ideally, you save enough to get the maximum match.

A real advantage of 401(k)/403(b) plans is the large amount you can save each year. Typically, you can contribute up to $18,000 annually, and those 50 and older can make a catch-up contribution of an additional $6,000 per year. These amounts are contributed by you before paying income taxes and will grow tax deferred until distributed in retirement. But remember, these funds are meant for retirement and are not easy to access if you need them sooner.

It’s worth mentioning a few other aspects of company sponsored plans. First, is the ease of administration and ability to setup automatic savings. Company plans make saving very convenient by taking money directly from your paycheck and depositing it in the retirement plan. Usually, the plan will automatically invest your savings in the investments you have selected in advance. This process makes saving for retirement very convenient.

Another feature of company plans is a pre-defined list of investments to choose from. This may be an advantage or a disadvantage. If you have little expertise in investing or little time to evaluate options, having a list of vetted investments to choose from can be an advantage. Then again, if you have a lot of experience and like to research investments, then the pre-defined list may feel like a limitation.

Individual Retirement Account

An IRA is another option for retirement savings. As the name implies, these accounts are individually owned and independent of your employer. These accounts are different from your employer plan in a few ways.

First, you can only contribute the annual max (for 2019 this is $6,000). There is an additional catch up contribution of $1,000 for people 50 years or older. Second, it is important to be aware that your income can limit the tax deductibility of contributing to IRAs. For those who have access to an employer plan, your tax-deductible contributions to an IRA can be limited or disallowed all together. The chart below can help you determine your status:

There are still advantages to contributing to an IRA even if the tax deduction is limited, since the growth of the assets would still be tax deferred. Keep in mind, these assets, like employer plans, are meant for retirement and can be difficult to access before age 59 ½.

Traditional vs Roth Contributions

To further complicate matters, every retirement savings conversation should include discussion of traditional versus Roth contributions.

Traditional contributions go into the account on a pre-tax basis where they grow tax deferred. When you distribute the funds in retirement, the money is taxed at your ordinary income tax rate. Roth contributions forego the initial tax deduction and in exchange get tax-free growth on the funds – forever. If you are young, and have a long working career ahead, then a Roth contribution almost certainly makes sense. If you are closer to retirement, then the choice becomes a bit trickier, and will depend on your expectation of your current and future tax brackets.

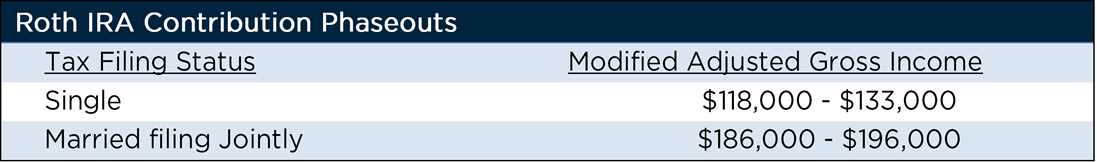

I should note that after-tax Roth contributions to your employer plan are not limited by your income, however they can be for an individual Roth IRA, as shown below:

Taxable Account

The third option for saving is a taxable account. There are no limitations on how much you can save each year. However, unlike your employer plan or IRA, the interest, dividends, and capital gains realized will be taxed annually.

A major advantage of this account is that it isn’t restricted in any way - you can access the funds at any age for any reason. Additionally, you can use this account to help control your taxable income in retirement. These aspects make the taxable account a nice compliment to your employer plan and IRA.

How Should You Save?

Remember the first step is to maximize your employer’s match. From there, the road map becomes less clear and depends on your individual situation. Coordinating taxes, access to your savings, and your investment options can quickly get overwhelming. Your financial advisor can help you develop the best plan for you and your goals.